Food tax calculator

The default setting is 70 with the allowable range of 50-100. Nj Food Tax Calculator.

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Effective tax rate 172.

. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. Your household income location filing status and number of personal. 13 HST 8 point of sale rebate.

May not be combined with other. Maximum Possible Sales Tax. To use our new jersey salary tax calculator all you have to do is enter the necessary details and click on the calculate button.

Purchase Location ZIP Code -or- Specify Sales Tax. Food Tax Calculator Nj. Sales Tax Rate Calculator.

Use this calculator to find the general state and local sales tax rate for any location in Minnesota. Virginia State Sales Tax. However these national averages vary based on where you live and the.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. The default setting is 150 centsoz with the allowable range of tax rates from 10. Average Local State Sales Tax.

The results do not include special local taxessuch as. Receipts from the sale of prepared food in or by restaurants taverns or other establishments in the state or by caterers including in the. The Indiana Department of Revenue DOR provides the food and beverage tax rates for each county or municipality in the table below.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Tax per ounce rate. Consequently Chicago restaurants within the McPier Tax zone administer an 1125 percent sales tax while those outside the zone administer a 1025 percent sales tax.

Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. 13 HST point of sale rebate of 8 on prepared meals 400 and under Alcoholic beverages. You may also contact your county auditors office to.

Sales Tax Rate for Food and Personal Hygiene Products Sales of food for home consumption and certain essential personal hygiene products are taxed at the reduced rate of 25. Maximum Local Sales Tax. The average cost of food per month for one person ranges from 150 to 300 depending on age.

Sales Tax Api Taxjar

Vermont Income Tax Calculator Smartasset

Lottery Tax Calculator

Sales Tax On Grocery Items Taxjar

Sales Tax Calculator

Tip Sales Tax Calculator Salecalc Com

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Sales Tax Calculator

Income Tax Calculator For Fy 2022 23 Ay 2023 24 Lenvica Hrms

Sales Tax Calculator Taxjar

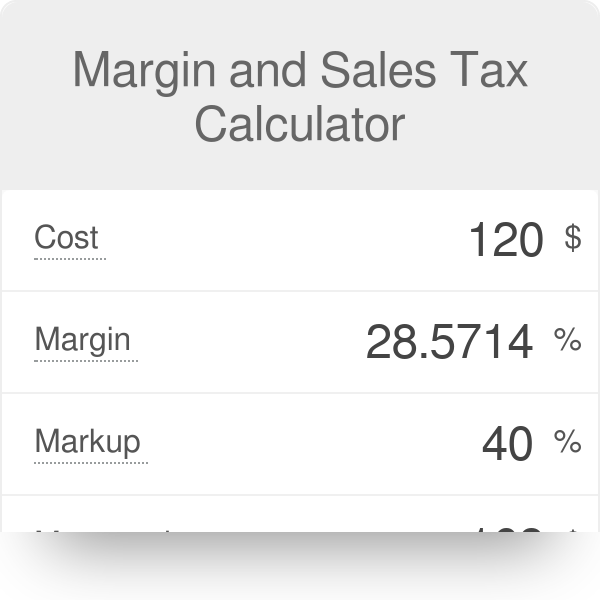

Margin And Sales Tax Calculator

Sales Tax Calculator

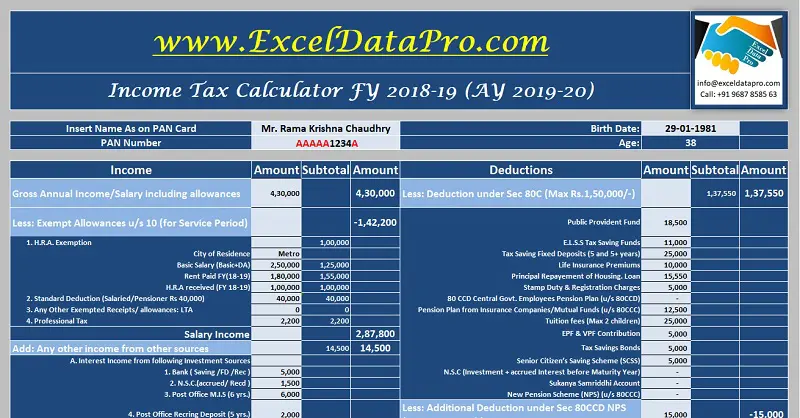

Download Income Tax Calculator Fy 2018 19 Excel Template Exceldatapro

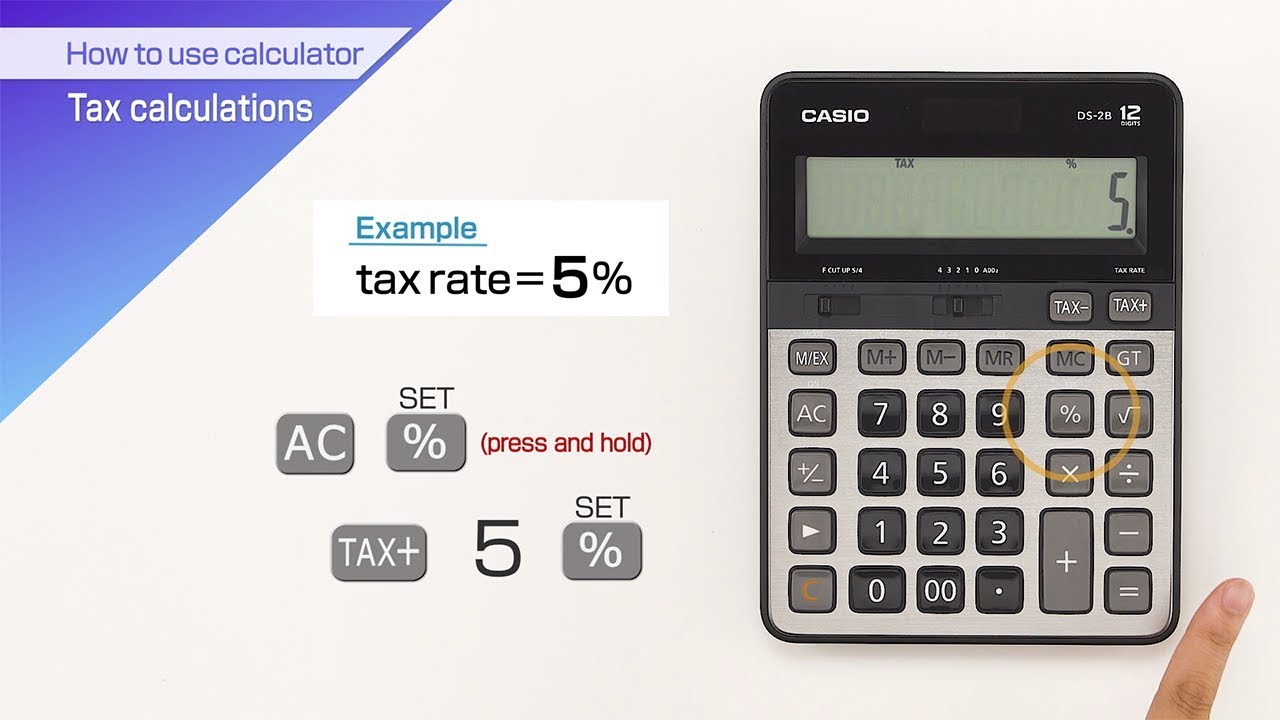

Casio How To Use Calculator Tax Calculations Youtube

What Is Sales Tax Nexus Learn All About Nexus

Vat Calculator

Sales Tax Calculator Taxjar